As you know, there is a wealth of resources available online to instructors of economics. This week, we wanted to share some blogs that we thought you might find useful. Return next week to see blogs that focus on the topics of personal finance and financial literacy.

Girl Scouts visit Phoenix Processing Center

Just a quick post today to share a photo of Troop 966 (Peoria, AZ) from the Girl Scouts Arizona Cactus-Pine Council, along with representatives of our Fed outreach team. These young women visited the SF Fed Phoenix Processing Center over the summer and got hands-on practice with personal finance by calculating income and creating a budget, along with learning how to save towards financial goals.

Just a quick post today to share a photo of Troop 966 (Peoria, AZ) from the Girl Scouts Arizona Cactus-Pine Council, along with representatives of our Fed outreach team. These young women visited the SF Fed Phoenix Processing Center over the summer and got hands-on practice with personal finance by calculating income and creating a budget, along with learning how to save towards financial goals.

The Girl Scouts also viewed our cash operations and saw the coin and cash supply for the state of Arizona, while learning about the life cycle of cash in the U.S. A treasure hunt for piggy bank souvenirs completed their visit.

If you know an Arizona Girl Scout troop that would like to participate in our Phoenix office’s Girl Scout VIP Pass program, see the flyer below for more information.

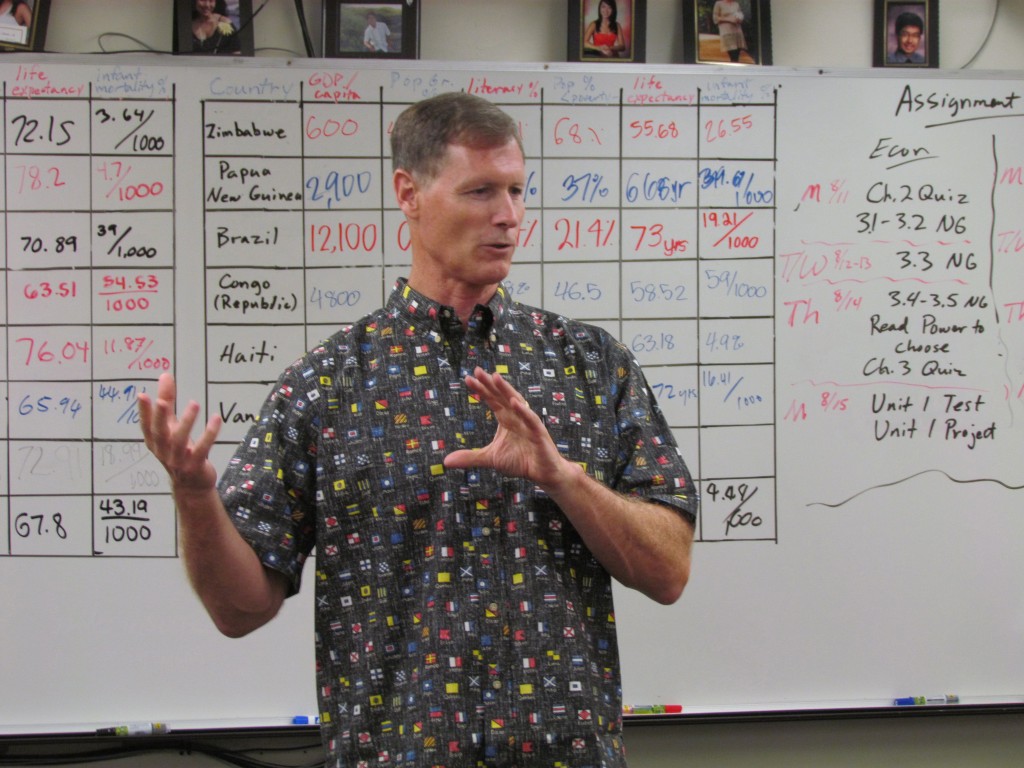

Teacher Spotlight: Greg Blandino

Our Spotlight series continues this week, where we talk with teachers who are making a difference in the field of economic education.

In today’s installment, we’re talking with Greg Blandino, who teaches AP economics (micro and macro) and college prep economics at Monte Vista High School in Danville, CA.

In today’s installment, we’re talking with Greg Blandino, who teaches AP economics (micro and macro) and college prep economics at Monte Vista High School in Danville, CA.

Here is what he had to say:

How long have you been teaching economics? What do you love most about it?

I’ve been teaching economics for 27 years. I love when students connect their day-to-day behavior to economics ideas, theories, and principles discussed in the classroom.

Teacher Spotlight: Jonnie Fenton

Our Spotlight series continues this week, where we talk with teachers who are making a difference in the field of economic education.

In today’s installment, we’re talking with Jonnie Fenton, who teaches economics, world geography, AP art history, and ancient medieval history at Hanford High School in Richland, WA.

Educators “Meet the Experts” in San Francisco

What happens when you mix brilliant economic minds and keen educators? An enthusiastic day of discussion, questions, professional development, and yes – even some fun! We recently hosted 70 educators from throughout the 12th District at our head office in San Francisco for Meet the Experts (MTE), a speaker series designed to provide secondary and post-secondary educators with an opportunity to interact with leaders from throughout the Bank.

With MTE, our objective is to highlight emerging issues in the economy and foster greater understanding about the roles and responsibilities of the Federal Reserve. See how we strove towards that goal with the day’s agenda. Remember to return to this blog in the following weeks as we’ll be providing tips for discussing this year’s MTE topics with your students.

With MTE, our objective is to highlight emerging issues in the economy and foster greater understanding about the roles and responsibilities of the Federal Reserve. See how we strove towards that goal with the day’s agenda. Remember to return to this blog in the following weeks as we’ll be providing tips for discussing this year’s MTE topics with your students.

The day started off with a dive right into economics content and a very timely topic: asset price bubbles. Kevin Lansing, Research Advisor for our Economic Research group, took the audience through a brief history of bubbles (notably the Tulip Mania bubble from 17th century Netherlands), then touched on three points that explain bubbles: forecasts based on past price movements, social dynamics and human emotion, and market structure. Kevin also discussed policy implications of lessons learned from price bubbles. His presentation slides are here.

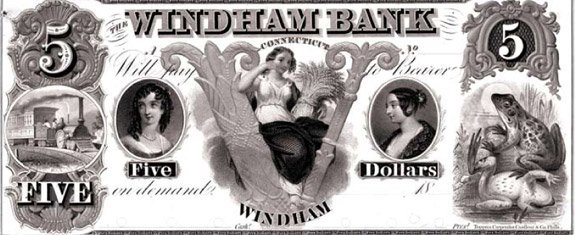

Spreading our wings beyond the bald eagle: wildlife on United States currency

This post is by guest writer Andrea Abrams, who is a Senior Coordinator with the SF Fed’s Economic Education department. Andrea leads a team of 38 staff outreach volunteers in our Los Angeles and Phoenix Branches who provide tours and personal finance workshops. Read her full bio here.

Most students know that the bald eagle features prominently on the United States cash in their wallet. When it comes to frogs, reindeer, and bison, however, students may be in for a surprise.

Wildlife meets economics in our nation’s cash past.

Fighting frogs

Some of the earliest American notes were issued by private banks, and often contained imagery that was meaningful to the local community. For example, the currency of Windham Bank, which was located in eastern Connecticut, featured a unique symbol that originated in local folklore.

A legend holds that one night in 1754, two local men were terrified by ferocious sounds of battle drawing near. Eager to protect their fellow residents, the two rushed home to gather reinforcements for what was presumed to be an enemy attack in association with the French and Indian War. No attackers were found, but in the morning the area was filled with thousands of bullfrogs who had apparently done battle the night before, possibly over the small amount of water in a nearby pond. This episode was immortalized in poetry and song…and on the local currency when Windham Bank issued a $5 private banknote depicting two frogs in combat.

Teacher Spotlight: Stan Herder

Our Spotlight series continues this week, where we talk with teachers who are making a difference in the field of economic education.

In today’s installment, we’re talking with Stan Herder, who teaches economics, government, and history at Hawaii Baptist Academy in sunny Honolulu, Hawaii.

Stan didn’t mention it in his responses below, but we’ll brag for him: He was awarded the 2013-2014 Smart/Maher VFW National Citizenship Education Teacher Award, which is offered by the Hawaii Veterans of Foreign Wars. The award recognized educators who are active in citizenship education, including topics such as government and economies.

Stan teaches economics (12th grade), government (9th grade), ancient world history (9th grade), and Hawaiian history (10th – 12th grade).

Stan teaches economics (12th grade), government (9th grade), ancient world history (9th grade), and Hawaiian history (10th – 12th grade).

Here is what he had to say:

Back to School with Bite-Sized Economics

With the summer winding down we’ve turned to getting ready for the new school year, and you probably are, too. To help get the ball rolling with your economics classes, we’ve compiled a short list of “Bite-Sized Economics” activities and discussions that can be easily integrated into the classroom. They come from our colleagues at the Kansas City Fed (see more of their educational resources here).

Concept to teach: Entrepreneur

One who takes a risk by producing a product or starting a new business

Bite-sized ideas:

- As entrepreneurs invent new products, they often make former products obsolete, or out of date and no longer used. An example of this would be the typewriter, which is now rare because of computer word processing. This concept is called “creative destruction.” Ask students to brainstorm and discuss other examples of creative destruction due to new inventions.

- After discussing entrepreneurship, ask students to interview an entrepreneur in their community. Interview questions could include: describing their business; explaining how they financed their venture; discussing any challenges in their business; and describing a typical work day. Share completed interviews with the class. (via)

Future leaders hone leadership, financial literacy, resume and interview skills at the Fed

We’ve been busy at the SF Fed’s Los Angeles Branch! On Tuesday and Wednesday of last week, 96 youth from the Academy of Business Leadership (ABL) visited for sessions on mentoring, financial literacy lessons, and resume and job interview skills.

We’ve been busy at the SF Fed’s Los Angeles Branch! On Tuesday and Wednesday of last week, 96 youth from the Academy of Business Leadership (ABL) visited for sessions on mentoring, financial literacy lessons, and resume and job interview skills.

Thursday saw the arrival of 42 members from the Girl Scouts of Greater Los Angeles for a similar experience. Both events were designed to develop leadership skills and to encourage careers in banking, business, finance, and economics.

In his welcoming remarks to the ABL audience, Roger Replogle, SF Fed Senior Vice President and Los Angeles Branch Manager, advised the young audience: “Learn to run to the fire – that’s where you find opportunity to grow, learn, and help. Don’t look for the easy path. Look for the hard one.” He shared stories of successes and failures, both personal and professional, and lessons learned.

Lise Luttgens, CEO of the Girl Scouts of Greater Los Angeles, provided welcoming remarks for the Girl Scouts event and stressed that “gender is no barrier to financial literacy and independence.”

Students and Money – The 2012 PISA results

This week we wanted to take a deeper dive into the recent PISA financial literacy assessment by looking at the test framework and reviewing a snapshot of student performance across the 18 countries that participated.

What is Financial Literacy? – PISA Definition

Financial literacy is knowledge and understanding of financial concepts and risks, and the skills, motivation and confidence to apply such knowledge and understanding in order to make effective decisions across a range of financial contexts, to improve the financial well-being of individuals and society, and to enable participation in economic life. (via)

The Students and Money Framework

The financial literacy assessment consisted of a total of 40 questions organized into three broad perspectives: content, processes, and context. Under each of these perspectives, four categories of questions were then identified. These 12 categories formed the PISA “framework” for measuring financial literacy, see table below: