It’s easy to become complacent about our finances with the vast number of websites, apps, and businesses available today that specialize in helping people manage their money. Granted, technology can be a powerful partner in financial management, but it cannot replace a strong understanding of factors that should inform decisions about how, where, and when we spend our money.

Why is financial literacy more important than ever?

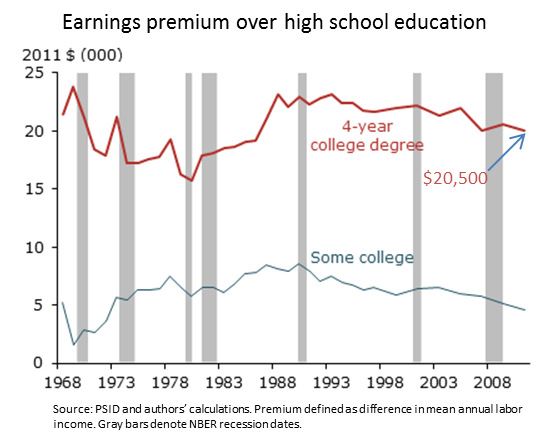

Our financial landscape has grown increasingly complex. Before a young person approaches college or a career, he or she is faced with big decisions on how much money to borrow for tuition, how much to save, how to invest, and how to grow and protect their budding wealth.

Dr. Annamaria Lusardi, a professor of economics and accountancy at the George Washington School of Business, wanted to test how financially literate populations are, both in the United States and internationally. What she found was surprising. She discussed her research recently at a TEDx Foggy Bottom gathering.

Currently in its second year of existence, the EAG is a group of approximately 20 teachers from throughout the nine western states that comprise the

Currently in its second year of existence, the EAG is a group of approximately 20 teachers from throughout the nine western states that comprise the