Join us in San Francisco on August 15 for an exciting and unique opportunity!

Meet the Experts is a speaker series designed to provide secondary and post-secondary educators with an opportunity to interact with leaders from throughout the Federal Reserve Bank of San Francisco. Our objective is to foster greater understanding about the roles and responsibilities of the Fed and to highlight emerging issues in the economy.

The event is a professional development opportunity that will bolster your knowledge about economics, and you will return to your students with fresh content and new teaching ideas. Set yourself up for success in the upcoming school year and register today.

Confirmed speakers include:

John C. Williams, President and CEO of the SF Fed. John is an expert on monetary policy and business cycles, and is a strong advocate for economic education.

John C. Williams, President and CEO of the SF Fed. John is an expert on monetary policy and business cycles, and is a strong advocate for economic education.

Mark A. Gould, First VP and COO at the SF Fed. Mark is responsible for all administration, operating, and financial services activities. He is also product director of the Federal Reserve System’s Cash Product Office.

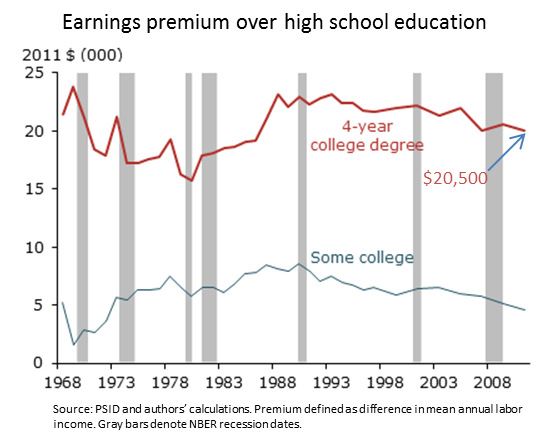

Mary C. Daly, Senior Vice President and Associate Director of Research at the SF Fed. Mary specializes in labor markets, public economics, and social welfare.

Kevin Lansing, Research Advisor, Federal Reserve Bank of San Francisco. Kevin specializes in macroeconomics, monetary economics, and asset pricing.

This event is open to high school, community college, and university educators. Students in teacher education programs are also welcome to attend. There is no fee for this event.

We are still in the planning stages of this event, and details are subject to change. Please check back for updates. Last year’s agenda will give you an idea of the exciting and informative content that will be included in the day.

Register now! We look forward to having you join us.