This post is by guest writer Laura Choi, who is a Senior Research Associate with the SF Fed’s Community Development department. Laura researches a variety of issues aimed at improving economic opportunities for low- and moderate-income communities. Read her full bio here.

With graduation season upon us, it’s a great time to get your students thinking about the future. There’s no question that a college degree is becoming more and more of a necessity in today’s economy. A recent Econcepts blog post highlighted new research from the SF Fed showing that a college degree is a worthwhile investment for the average student as it leads to higher lifetime earnings.

At the same time, the news is filled with stories of individuals struggling to repay their student loans, and President Obama just announced new executive actions to “lift the burden of crushing student loan debt.”

But student debt doesn’t have to be crushing or scary, and a little information can go a long way in helping students make sound financial decisions when it comes to financing higher education.

Here are a few ideas that can help your students get a better understanding of student debt.

Get educated on paying for college

What’s FAFSA? Grants, loans, or work-study? Subsidized vs. unsubsidized? Federal Direct, Perkins, Pell? Navigating the world of financial aid may seem like learning a new language, but the Consumer Protection Financial Bureau (CFPB) has a Paying for College tool on their website that helps students make sense of the numerous options out there. The site offers resources for prospective college students, such as a financial aid comparison tool, as well as debt repayment information for current students.

In addition to the CFPB, there are plenty of resources available that offer lots of great data on college costs and student debt, such as the Project on Student Debt or the College Board.

Not all debt is created equal

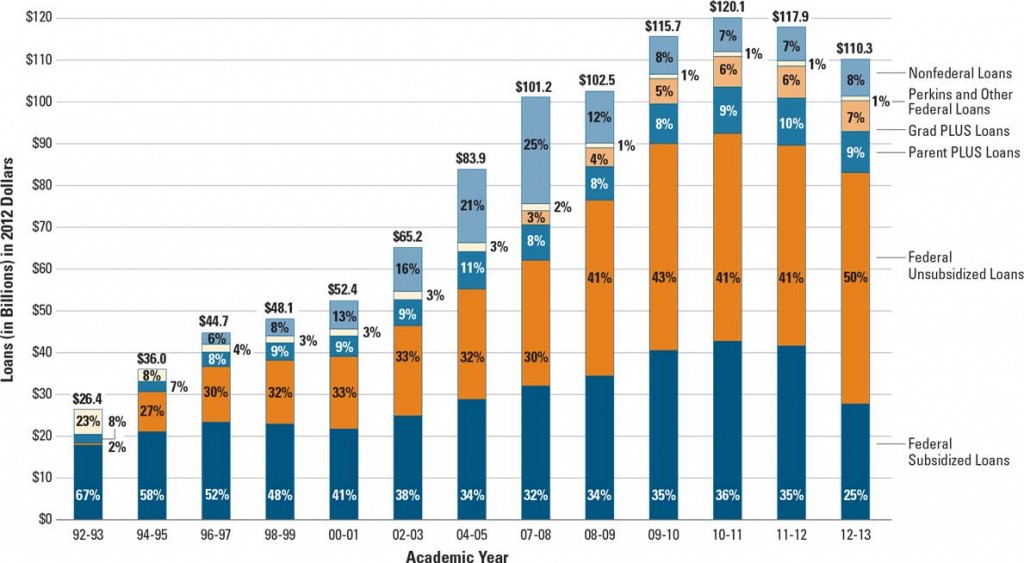

As we learned with the mortgage crisis, not all debt is created equal. Students need to understand the terms and conditions of the different types of educational loans they undertake. As shown in the chart below, the years leading up to the Great Recession were marked by growing total student loan balances, with a particular spike in private (nonfederal) loans.

In the 2007-2008 academic year, right before the economic crash, private loans made up 25%of total student loans, versus just 6% from a decade earlier. Compared to federal loans, these private loans often carry higher, variable interest rates and do not offer as much flexibility in terms of repayment options.

Growth of Federal and Nonfederal Loan Dollars in 2012 Dollars,

1992-93 to 2012-13, Selected Years

Not all educational institutions are created equal, either

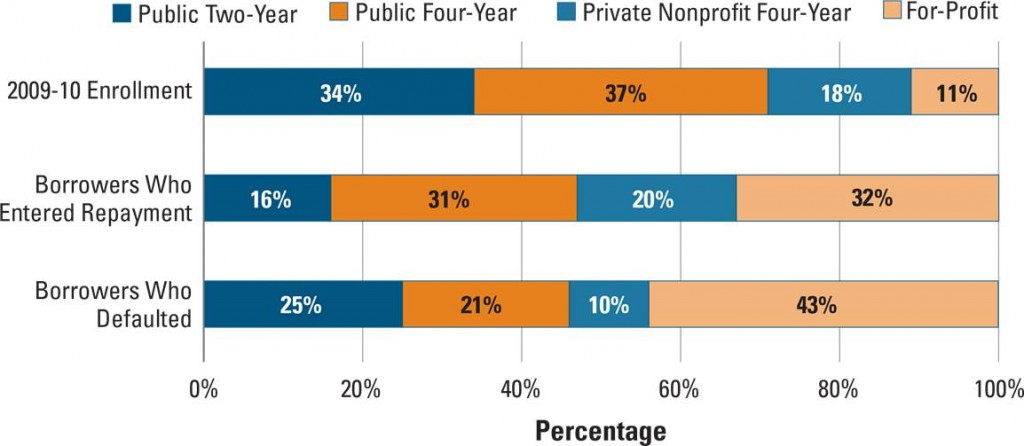

As discussed in a recent blog post from the SF Fed’s Community Development department, the incidence of student loan default is disproportionately higher at for-profit colleges (see the chart below). This is of particular concern for lower-income students, who make up the largest share of for-profit college students.

This is not to say that any one type of institution is better than another, as students will have different needs that can be met by different types of institutions. However, students should educate themselves on the institution they’re interested in attending and learn more about that school’s track record when it comes to important factors such as graduation rates, job placement rates, and student loan default rates.

Distribution of Total Enrollments, 2009-10, Borrowers Entering Repayment in FY 2011, and FY 2011 Two-Year Cohort Default Rate, by Sector

Learn More

You can learn more about student debt and default in this Community Development Research Brief.

And tell us: what kind of trends are you seeing from your students in terms of college attendance? Do they consider debt as they weigh post-secondary options?