There are many possibilities for students’ life after high school and lots of questions to consider along the way. “What path is right for me?” “What do I stand to gain?” “What are my funding options for school?”

We have been developing Invest in What’s Next (IIWN), an interactive, online mini-course with the Federal Reserve Bank of Richmond. Through three lessons, students will explore their options, budget for their future, and build a plan that’s right for them.

We are happy to announce that lesson 1 has been launched and is ready for you to assign to your students! After completing lesson 1, students will be able to:

- determine what jobs best fit their personal interests and the education required for those jobs

- estimate what they want their future lifestyle to be and the income they may need to earn to support that lifestyle

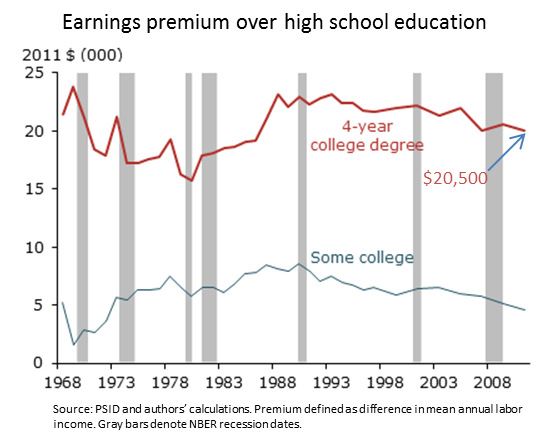

- identify the benefits of education after high school

- assess the degree levels and school options for education after high school

- research education options that meet their goals

- analyze charts and data in a variety of formats